Investing in Bitcoin: A Smart Move or Risky Business?

Bitcoin, the pioneering cryptocurrency, has captured the imagination of investors worldwide. Born in the aftermath of the 2008 financial crisis, Bitcoin was introduced as a decentralized and borderless alternative to traditional currencies. In this article, we will explore the intricacies of Bitcoin as an investment, weighing the potential benefits against the inherent risks. Investing in BTC can be risky but if you have enough understanding, you can get the most out of it. Trade Edge Ai can connect you with a top investing education firm that can make you an informed investor.

Proficator is a platform designed to democratize financial education. It connects individuals eager to learn about investing with expert educators who can break down complex financial concepts into easily understandable lessons. By offering accessible and informative content, Proficator aims to empower people to make informed financial decisions. The platform emphasizes the importance of knowledge acquisition before venturing into the investment world, guiding users from basic investment principles to advanced strategies.

Understanding Bitcoin

Blockchain Technology: The Foundation of Bitcoin

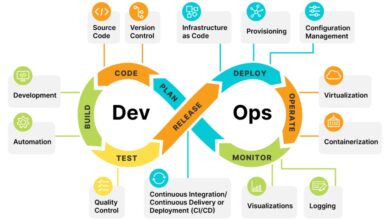

Bitcoin operates on a decentralized ledger system known as blockchain. This technology ensures transparency, security, and immutability of transactions. Each block in the chain contains a cryptographic hash of the previous block, creating a secure and interconnected system resistant to tampering.

How Bitcoin Transactions Work

Bitcoin transactions involve sending and receiving funds through digital wallets. These transactions are verified by a network of nodes using cryptography. Miners play a crucial role in confirming transactions and solving complex mathematical problems to add new blocks to the blockchain.

The Role of Miners in the Bitcoin Ecosystem

Miners validate transactions and secure the network by solving computational puzzles. In return, they are rewarded with newly minted bitcoins. The mining process also introduces scarcity, as the total supply of bitcoins is capped at 21 million, with periodic halving events reducing the rate of new bitcoin creation.

The Advantages of Investing in Bitcoin

Potential for High Returns

Bitcoin’s price history has been marked by significant volatility, offering opportunities for substantial returns. Early adopters who embraced the cryptocurrency when its value was minimal have witnessed remarkable appreciation, fostering a narrative of Bitcoin as a high-yield investment.

Decentralization and Independence from Traditional Financial Systems

Bitcoin operates independently of central banks and government control. This decentralized nature appeals to those seeking financial autonomy and a hedge against economic uncertainties. The absence of intermediaries enhances transactional privacy and reduces the risk of censorship.

Limited Supply and Scarcity: The Halving Effect

Bitcoin’s predetermined supply cap, coupled with periodic halving events, introduces scarcity akin to precious metals like gold. The controlled issuance and diminishing rate of new bitcoins contribute to the perception of Bitcoin as “digital gold,” with scarcity potentially driving up demand and value.

Risks Associated with Bitcoin Investments

Market Volatility: Price Swings and Speculative Nature

Bitcoin’s price can experience rapid and unpredictable fluctuations, leading to both significant gains and losses. The speculative nature of the market makes it susceptible to external factors, such as regulatory developments, technological advancements, and macroeconomic trends.

Regulatory Uncertainty: Legal and Compliance Challenges

The regulatory landscape for cryptocurrencies is evolving, with varying degrees of acceptance globally. Regulatory changes can impact the legality and viability of Bitcoin investments, posing challenges for investors navigating a shifting legal environment.

Security Concerns: Hacks and Frauds in the Cryptocurrency Space

Cryptocurrency exchanges and wallets are susceptible to hacking attempts and fraudulent activities. High-profile incidents of security breaches underscore the importance of secure storage solutions and the need for investors to exercise caution when selecting platforms for transactions.

Bitcoin in Comparison to Traditional Investments

Bitcoin vs. Gold: A Digital Gold Narrative

Bitcoin’s comparison to gold extends beyond scarcity. Advocates argue that Bitcoin’s portability, divisibility, and ease of transfer make it a superior store of value in the digital age, challenging gold’s historical role as a haven asset.

Bitcoin vs. Stocks: Risk and Reward Evaluation

Unlike traditional stocks, Bitcoin is not tied to the performance of a specific company or industry. However, its value can be influenced by broader market sentiments. Investors must assess the risk-reward profile of Bitcoin relative to traditional equities.

Bitcoin vs. Fiat Currencies: Inflation Hedge or Speculative Asset?

As central banks engage in expansive monetary policies, some view Bitcoin as a hedge against inflation. However, its volatile nature and lack of intrinsic value prompt skeptics to question its role as a stable alternative to fiat currencies.

Strategies for Mitigating Risks in Bitcoin Investments

Diversification: Building a Balanced Crypto Portfolio

Diversifying one’s cryptocurrency portfolio beyond Bitcoin can mitigate risk. Including other established cryptocurrencies with different use cases and risk profiles can enhance overall stability.

Research and Due Diligence: Choosing Reputable Exchanges and Wallets

Thorough research is essential when selecting cryptocurrency exchanges and wallets. Security features, reputation, and regulatory compliance should be carefully evaluated to safeguard investments against potential risks.

Long-Term vs. Short-Term Investment Approaches

Investors must define their time horizon and risk tolerance. While short-term trading can capitalize on market volatility, long-term strategies may benefit from the potential appreciation of Bitcoin over time.

The Future of Bitcoin and Its Impact on the Financial Landscape

Institutional Adoption: Companies and Funds Investing in Bitcoin

Increasing institutional interest in Bitcoin, evidenced by corporations adding it to their balance sheets and investment funds allocating capital, suggests growing mainstream acceptance. This institutional adoption could contribute to Bitcoin’s legitimacy as an asset class.

Government Initiatives: Regulations and Central Bank Digital Currencies (CBDCs)

Governments worldwide are navigating the regulation of cryptocurrencies. The development of central bank digital currencies (CBDCs) adds a layer of complexity, as authorities seek to balance innovation with regulatory oversight.

Technological Developments: Upcoming Changes in the Crypto Space

Advancements in blockchain technology and layer-two solutions aim to address scalability and transaction speed issues. These developments could enhance the utility of Bitcoin and position it as a more practical medium of exchange.

Conclusion

In summary, delving into Bitcoin investments demands a nuanced approach, necessitating a deep grasp of its technological foundations, market dynamics, and inherent risks. While the allure of substantial returns is evident, investors must adeptly maneuver through challenges such as market volatility, regulatory ambiguities, and security considerations. The evolving nature of Bitcoin signifies its profound impact on the financial realm, presenting both promising prospects and potential pitfalls for those stepping into the realm of cryptocurrency investments. In this intricate landscape, it becomes imperative for investors to remain well-informed, making decisions with meticulous deliberation.